The Essential Mental Model for Understanding Innovation

Elliot Turner Posted on

Elliot Turner Posted on  Thursday, March 8, 2012 at 3:23PM

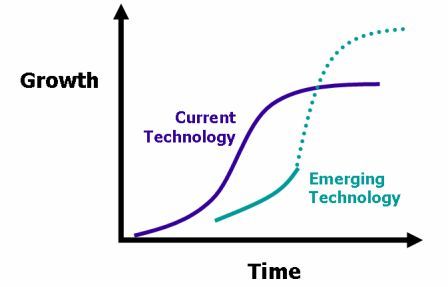

Thursday, March 8, 2012 at 3:23PM The other day I came across this excellent video interview on the Harvard Business Review blog with Clayton Christensen discussing “disruptive innovation.” As some of you may know, Christensen wrote The Innovator’s Dilemma. This is one of the most important investment books for everyone to read. It is essential for understanding the paradigm of innovation and disruption in business. If there’s ANY tech CEO (or even non-tech CEO) who has not read this book I would have to seriously question their judgment as an executive. This book is that important.

By operating in this way, the young upstart is able to profitably grow a business while refining and developing the product until it eventually is a cheaper, better and eventually a replacement for what the dominant market leader has to offer. Meanwhile, the market leader, in an effort to protect their market position and profit margins, and to cater to the needs of their largest customers, never enters into the new level to their core market because they refuse to take part in driving prices, margins and profits lower in the short-run. Christensen narrates this phenomenon and develops the theory primarily through an analysis of the disk drive market, where these innovations tend to transpire at a far quicker pace than other arenas.

Mark Suster, a “2x entrepreneur turned venture capitalist” wrote several outstanding posts on the Innovator’s Dilemma and how it not only impacts, but is a core element of his own personal investment strategy. I highly recommend reading both The Amazing Power of Deflationary Economics for Startups and Understanding how the Innovator’s Dilemma Affects You. One point that I would add to Suster’s analysis is while the new firm accepts lower margins, they do so for particular products, not on a firm-wide scale. These disruptive technologies are able to sell each unit of their product for a lower margin; however, their technology affords them the advantage to spread the fixed cost element in a much more beneficial way such that the firm-wide margins are far greater than the incumbent technology. Typically the firm-wide advantage comes via the capacity to support enormous scale on a smaller operating structure. This is particularly true in the Internet age. And in this fact lies the ability to compete on price on a per unit basis.

Steve Blank is a pioneer in entrepreneurial theory, professor at Stanford and author of Four Steps to the Epiphany. His impact is visible throughout the many innovative powerhouses born in Stanford. He wrote an excellent post that relates the Innovator’s Dilemma to how large enterprises can cope and prosper in such an environment called The Search for the Fountain of Youth: Innovation and Entrepreneurship in the Enterprise. This too is a must read.

Reader Comments