The Market's Betting Line: A Look at Implied Growth

Elliot Turner Posted on

Elliot Turner Posted on  Thursday, February 27, 2014 at 1:32PM

Thursday, February 27, 2014 at 1:32PM This post is co-written by Elliot Turner and David Doran

There’s been a great conversation in the blogosphere specifically about the validity and predictive power of Cyclically Adusted P/E Ratios (aka CAPE) and more generally about the valuation of US equities. The incredible run of the last year has only made the valuation debate more important. John Hussman has been one of the more vocal advocates on the Bearish side, while the pseudonymous @JesseLivermore from the Twittersphere has done an outstanding job deconstructing CAPE. In doing so, @JesseLivermore has highlighted why CAPE might not be relevant along with presenting an alternative way to look at valuation.

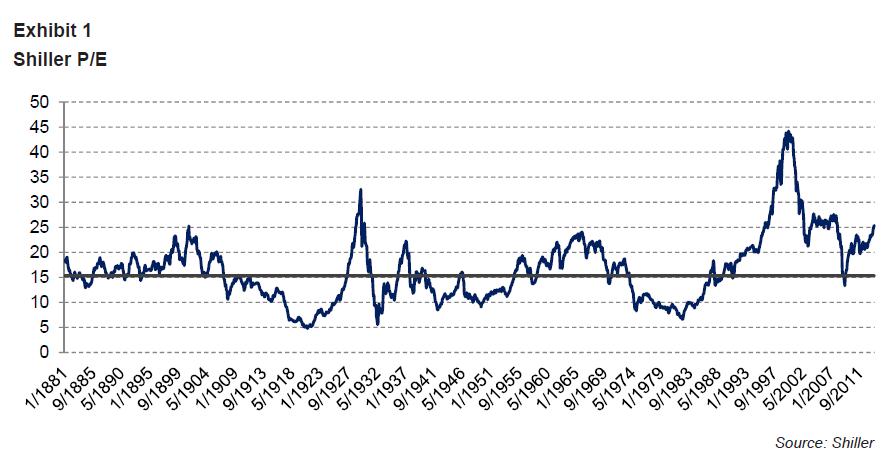

Here is what the CAPE looks like right now:

We think indicators like the CAPE offer valuable information, though they can never be looked upon conclusively. Further, we think that no one indicator has any worth outside of context. In an effort to simplify, context is often underappreciated in the investment community.

One key area where CAPE fails to ascertain the context is how it thinks about the valuation of businesses. Since the CAPE deals with P/E, it is purely a reflection of the price of a security, relative to its earnings power. This ignores capitalization, and as such, presents a considerable problem for comparison across time. Consider: a company that trades at $100 per share with $10 cash/share and $0 debt/share that earns $10 in net income/share vs a company that trades at $100 per share with $0 cash/share and $10 debt/share that also earns $10 in net income. On a P/E basis, both companies trade at a 10 P/E, though both companies are not “worth” the same. Assuming all else is equal, the company with a net cash position of $10/share is clearly worth more to the equity holder than the company with $10/share of debt.

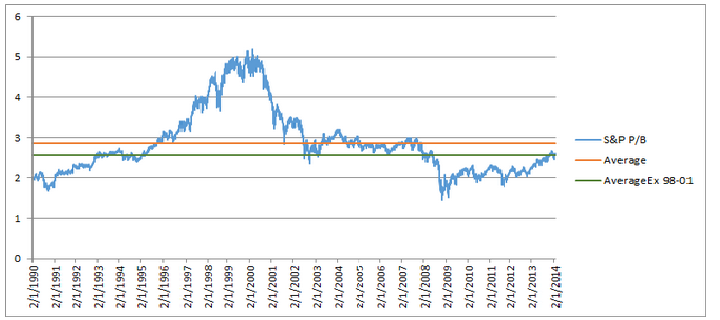

For this reason, some turn to the market’s Price to Book ratio, or the Tobin Q in order to gain insight from the relationship between the market price and companies’ asset value. In fact, Eugene Fama in his studies on market efficiency long ago documented that a low P/B has high predictive power for outsized returns. While Fama was specifically referencing individual securities, it is reasonable to conclude that buying the market at lower P/Bs should thus lead to higher returns than buying at high P/Bs.

As of today, the market’s P/B is similarly situated to where it was when the 1990s bull market began in 1995. It is below the average P/B of the last 24 years and right at the average of this timeframe if you exclude the 1998-2001 bubble years. While not at extremely low levels, the P/B is near the low-end of its range of the prior 24 years. While some may argue CAPE is better at incorporating the mean-regressing nature of the market than P/B, book value itself is a slow-moving metric and gives us a sense of where the tangible worth of businesses stand. Further, changes in book value are far less volatile than changes in earnings, and as a result, book value offers investors a more stable arbiter of value. Altogether, P/B tells a very different story than CAPE.

We do not want to take the extra step of concluding whether the market is fairly priced, cheap or expensive in today’s environment. Instead, our goal is to lay out an additional concept--implied growth--as another contribution to the CAPE Debate, show where the bar is set in terms of future expectations, be slightly suggestive as to which way we lean, but ultimately leave it to you the reader to decide and opine on whether the market’s estimation of implied growth is fair or not. That being said, we do think it’s a stretch to call today’s valuations extreme. The numbers implicit in today’s market price are rationalizable when viewed in the proper context and compared to historical levels of growth, cost of capital and returns.

Earnings and Book Meet at Implied Growth

Looking at P/B in conjunction with CAPE certainly provides better context, and consequently, better predictive power for investors; however, in our opinion, we felt there were still limitations to this approach. What if there were a way to look at earnings relative to book? A way where earnings and book value could be used together to get a sense for where the market’s valuation stands? We could look at ROE over time, which is reflective of the relationship between P/B and P/E, but that datapoint alone looks like the definition of a random walk.

One thing we could do is invert (start with a certain datapoint and work backwards), to figure out what we really want to know: at what level of market valuation can I expect the best future return? There is a formula which allows an investor to figure out what the P/B ratio for a given security should be, if you know the ROE, Implied growth (g), and cost of capital (r). This formula is a derivation of the Dividend Discount Model, which is based on the incontrovertible principle that an asset is worth the sum of its discounted future cash flows.

Justified P/B = (ROE- g) / (r - g)

For the purposes of the market, it turns out, we can actually plug in every single one of these variables to the equation aside for the growth rate. This is extremely valuable, because then we can adjust the formula to solve for what the level of implied growth is, given ROE, cost of capital and P/B. This is an extremely useful metric because it will tell us what level of earnings growth the market is pricing in at this current moment in time. We can then compare our current data point to implied growth historically to provide context. Using the context, we can then judge whether the market is being too optimistic or pessimistic.

As of today, here is the information we know:

Market’s P/B = 2.58

ROE(10 year average)=13.62%

r (WACC) = 7.91% (We have used the Equity Risk Premium as estimated by Aswath Damodaran and added it to the 10 year Treasury yield. See our discussion on WACC below)

When we plug these numbers into the equation above and solve for g, we get a result of g=4.31%.

It’s important to define what exactly this number means. When we talk about growth, we are talking about the implied growth rate of underlying earnings, which means this number is inclusive of the net effect of equity issuance (repurchases). In other words, if companies in aggregate were net issuers of new shares, then this would be a drain on future growth; conversely, were companies to repurchase shares this would be accretive to future growth.

One of the shortfalls of CAPE analysis that @JesseLivermore astutely pointed is how today and yesterday are not exactly the same. Making matters yet more complex is that no two datapoints in the marketplace are stationary on even an intraday basis. The world is dynamic and things change fast. This is but one reason why we like looking at implied growth. Implied growth does something for us that neither CAPE nor any other backwards looking metric tells us: implied growth provides a very clear threshold level for which the future needs to match in order for us to capture our desired return (desired return being the 10-year Treasury plus an Equity Risk Premium). Simultaneously, implied growth tells us what levels of growth will leave us short of our desired return, and what hurdle we need to clear for an outsized return.

The key takeaway here is that in order for an equity investor today to earn his/her cost of capital (7.91%) then earnings must grow at a rate of 4.31% from here on out. In essence, this 4.31% serves as our betting line: if growth hits the over, an investor should earn in excess of his cost of capital; and if growth hits the under, then an investor’s earnings will fall short of the cost of capital. Historically g has been in the range of 5-6%, having averaged 5.3% since 1950. This suggests that in isolation, today’s levels are in-line with the “slow-growth” environment so many market analysts make reference to.

Investors can then use this benchmark and ask hypothetically: what would my return look like ten years down the line, given different levels of actual realized growth, holding all else constant? Let’s say the growth in earnings actually tracks at 3.31%, falling a full 1% shy of the 4.31% implied in today’s market price. Holding P/B and ROE constant, we can then solve for “r” to get our expected return. With 3.31% growth, we then find that “r”=7.31%. This would leave us 60 BPS of our expected return based on today’s metrics. Alternatively, let’s say growth ends up a full 1% above 4.31%. Solving for “r” we see that our expected return would check in at 8.53%, or 62 BPS above today’s level. Let’s say you were concerned about a rise in interest rates, and wanted to know what implied growth would look like were benchmark rates to rise by 1%, then you could add 100 BPS to the 7.91% WACC, hold ROE and P/B constant and again solve for “g”. We then learn that were rates to rise by 1%, the market would be pricing in 5.93% growth in EPS. We’ll have a deeper discussion about rates below. While we present these as examples, it’s possible for an investor to model out numerous different scenarios using this equation, assuming various paths for interest rates, ROE and/or growth.

There’s an important point to make here: an investor need not make precisely 7.91% over time even if growth were to come in precisely at 4.31% annualized. This is merely reflective of the rate at which intrinsic value will increase by, and what at what level the market would be fairly valued. As we should all know by now, markets often overshoot to the upside and to the downside. There is also a high degree of path dependency depending on when an investor’s capital needs take place. Were all our equation inputs to stay exactly the same for 10 years except for the denominator in P/B (ie were the index price to stagnate, but ROE, WACC and g to stay the same over that time period) then the outcome would be a very cheap equity market, but no actual return on capital over the prior decade. To an extent this is an oversimplification considering an investor would also earn dividends that can be reinvested, thus increasing the overall yield on the portfolio as time marches on; however, the fact remains that it’s certainly possible for the justified value to work out as planned, but at the same time, for Mr. Market to not cooperate.

One more beautiful feature of this equation is that we can deploy it with equal veracity and power in individual stocks or for the broader market, whereas CAPE’s power is confined to the broader market and to a lesser extent, cyclical stocks. There is a second nice element as applied to the micro: the level of implied growth in the market provides us a nice reference point to think about individual company valuations. We can use this level as a benchmark from which to say a given stock is expensive or cheap. If a stock’s expected growth is greater (less) than the market’s implied growth, then that company most likely deserves an above (below) market multiple. But this point is merely an aside.

Micro Factors that Matter in the Big Picture

In the discussion on CAPE, many warning about overvaluation today cite “artificially low interest rates” as distorting the discount rate applied to equity valuations. In the context of CAPE this is a point (albeit one we would still argue is weak). In the context of looking at implied growth, that point is rendered moot entirely. One must be a realist and look at the actual, factual influence that interest rates play in the cost of capital for a company. Low interest rates, as is evidenced in various arena, allow borrowers to tap into capital at a lower cost. Rates at some point will eventually rise and raise the cost of capital. However, given the length of time of low interest companies had ample time to finance themselves cheaply and lock in rates for the long-term. The early years in a rising rate regime will be somewhat mitigated by companies already having secured low rate financing.

Let us illustrate how these low rates work to a company’s advantage. Assume we managed a company and were planning to undertake a new project. From this new project, we expect a return of $100 on an investment funded with $100 of debt (and $0 equity) at a 10% interest rate. If everything were to go smoothly, our return would be $100 minus the cost of our debt, or 10% of $100. We can write this out as $100 - ($100 * 0.10) = $90. Now let’s say interest rates for our company’s debt were to drop to 5%, but our expected return were to stay exactly the same. The math on this very same project would turn into $100 - ($100 * 0.05) = $95. Nothing changed insofar as the opportunities for the business go; however, it would now be able to earn $5 extra on the very same project purely because of the lower cost of capital.

Complain all you would like about interest rates being “artificially” low, but the reality of the situations is clear. So long as companies can and do tap into lower cost sources of capital, then the returns available to those companies will rise accordingly. We will let academics handle the debate about how and why interest rates are so low and instead we will focus on business analysis and looking at the ways in which low interest rates tangibly alter the math in valuing companies.

Stated another way, the change in interest rates is shifting a portion of returns on corporate investment from the pockets of bondholders to the pockets of shareholders. When Siemens did a debt-backed share repurchase, their CFO, now CEO, Peter Loescher had the following to say: “Our plan to swap expensive equity for historically cheap debt capital is being executed in grand style. The fixed interest rates we’ve obtained will ensure that we’ll continue to profit from today’s extremely favorable conditions over the long term.” We see this as a stated corporate objective from many blue chip companies around the world, with Federal Express recently joining the chorus in announcing a simultaneous bond issue and share repurchase. Fedex issued $2 billion in bonds with rates ranging from 4% to 5.1% in order to buy back more stock. Their ROE is currently 9.9%. In 2013, a highly levered company like Tenet Healthcare was able to issue debt at 4.25% and 4.375% and directly use the proceeds to retire debt at 8.875% and 10.00% respectively. The bottom line is that this is valuable to shareholders.

If you are spending time arguing whether low interest rates are justifiable, you are mistaking the forest for the trees and failing to see that companies are actually capitalizing on the status quo in order to drive shareholder value into the future. If you are able to hold ROE static but send WACC lower, then all of a sudden, you have created extra value for shareholders. This is the outcome of the point we were making above about companies capitalizing on the low cost of interest rates.

The Historical Context of Implied Growth

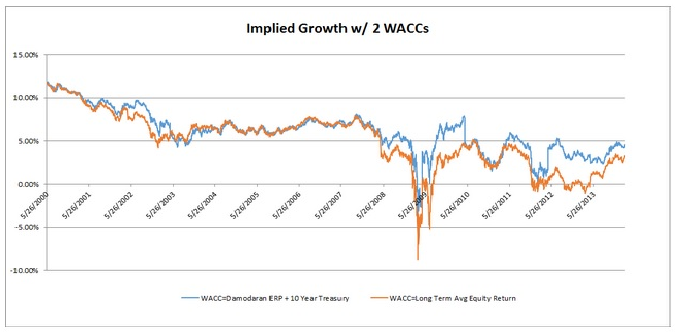

To construct a chart of implied growth for the S&P 500 since mid-2000, we had to come up with a cost of capital to plug into the equation. The first thing we did for cost of capital was using Aswath Damodaran’s Equity Risk Premium and adding that to the 10-year Treasury yield at each point in time. Each datapoint uses the rolling 10 year average ROE for the S&P 500 and the TTM book value for the purposes of P/B. We plugged in the known numbers to the equation above and solved for implied growth on a rolling basis.

Since something like the cost of capital can be highly subjective and very noisy from day-to-day depending on changes in the market’s price and equity risk premium, we decided to take a second look using the historical long-run return on equities. We did this because we thought it would be important to try and drown out some of the “noise” in the data created by these fluctuations. That was done by taking the actual annualised equity return for that particular data point going back to 1929 and then adding the spot ten year yield to approximate a “historical wacc.” For example, to get the equity risk premium for the year 2001, we took the total annualised returns of the S&P 500 from 1929 to 2001 and subtracted the total annualised returns of the 10-year Treasury over that same time period to give as an approximation of the actual excess return earned by equity holders over that time period. For the WACC, we then added that number to the 10-year spot Treasury at that point in time.

This is what we found using both WACCs:

Low P/B inherently means that the implied growth sets a lower hurdle for an investor to earn their cost of capital. This is so even when combining a low P/B and a historically average ROE. From both of these charts it becomes pretty obvious just how obscene the implied expectations were in the indices in 2000. Especially considering that eps growth has averaged 5.3% since 1950. 2011 is another interesting data point, During the European debt crisis sell off, the S&P was pricing in close to 0 eps growth despite actual robust eps growth and a bounce back in ROE’s. In fact, the orange line shows clearly that for much of 2011 and 2012, markets were pricing in zero earnings growth in perpetuity. This is consistent with much of the rhetoric. While the popular discussion has shifted towards “multiple expansion” being the sole driver of equity returns in 2013, it’s important to consider the context: equities went from pricing in absolutely no growth, to pricing in fairly modest growth assumptions.

It is with this implied growth equation we can see very clearly exactly what people are referring to when they say “multiple expansion” has been the driver of returns. Interestingly, since the bounce-back from the Great Recession began, the 5% threshold for implied growth has been strong resistance for equity markets. Each time implied growth has reached those levels, markets have either sold off or gone sideways. In light of the aforementioned 5.3% average annual growth since 1950, this market action is consistent with the “low growth” environment theme, as equities have basically been ping-ponging between zero implied growth and 5% ever since the bounceback from crisis began.

It’s also worth pointing out how despite the S&P 500 being higher today than it was in 2000, the implied growth is much lower. Through this, we can visualize how the market’s multiple has compressed over time. In valuation theory, another way to breakdown value is to think of the equation Current Value = Tangible Value + Future Value. When implied growth is lower, then the future value portion of this equation is also lower, but the tangible value level is higher. Tangible value includes the present asset base of the company and the value of the company’s sustainable earnings level. Here we can see pretty clearly the impact that increasing capitalizations of corporations can have on the question of fair value, something that CAPE simply cannot and does not do.

Disclosure: Both authors are long shares of Siemens (NYSE: SI)

CAPE,

CAPE,  ROE,

ROE,  david doran,

david doran,  implied growth,

implied growth,  price earnings ratio,

price earnings ratio,  price to book | in

price to book | in  The Market

The Market