Do You Believe in Evolution? (S&P 500 Edition)

Elliot Turner Posted on

Elliot Turner Posted on  Monday, March 26, 2012 at 7:28PM

Monday, March 26, 2012 at 7:28PM With equity markets breaking out to multi-year highs, amidst a persistent spate of negativity, there are all kinds of stories designed to scare people into thinking there is something sinister behind the rally. Some argue that without Apple, the S&P 500 would be going nowhere, some argue that profit margins are too high and must regress, while others argue that the cyclically adjusted P/E (CAPE) remains elevated and inconsistent with a longer-term bottom). All of these arguments have some merit, but none of them measure a key point: today’s S&P 500 is not yesterday’s S&P 500.

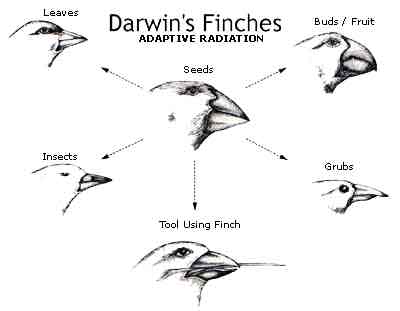

What do I mean by this? Well quite simply, there is some serious Darwinism going on in the indices, with the outcome being that survival of the fittest has a strong upward bias. Since the market peaked in October of 2007, exactly 100 companies have been added, and 100 removed from the S&P, with the vast majority of the change having happened during the 2008-09 collapse. I don’t have the long-term data, but I would surmise a guess that this was the period of the highest turnover in our most prominent benchmark index EVER. If anyone has the data necessary to confirm this, I would greatly appreciate it. Regardless, I think it’s safe to say that at the very least, over these last few years we have witnessed one of the largest shakeups in the constituent holdings of the S&P since the Index’s inception.

This is consequential for many reasons. One particularly important reason, and the inspiration behind my digging into the numbers is the fact that while reading numerous comparisons of the S&P 500 pre and post-2007, not a single analysis I have seen has mentioned or attempted to dig into the composition of the index. Meanwhile every day I read something that tries to assert Apple is skewing the index. After looking at the data, it’s become clear that while Apple is a large force, the turnover in the constituent holdings has had a much bigger impact. Just from the turnover alone, the S&P has been tilted away from financials and old sluggish companies with little to no growth, towards technology and innovative, young companies with rapid expansion.

Out of the 100 companies removed from the S&P 500, 20 were financials that either went bust, were bought out while in distress, or their market caps shrunk so much they were no longer relevant. Another 7 companies either went bankrupt, or were near bankrupt due to their exposure to the debt crisis, or the rapid disruption of their business model during the crash.

Here’s a selective list of some notable removals from the S&P 500 since October, 2007 (this list is not comprehensive, but rather just some notable departures):

- Circuit Cities

- Ambac Financial Group

- Countrywide Financial Corp.

- Federal Home Loan Mortgage Corp (aka Freddie Mac)

- Federal National Mortgage Association (aka Fannie Mae)

- Lehman Brothers

- Washington Mutual

- Merrill Lynch

- General Motors

- CIT Group

- MBIA

- KB Home

- RadioShack

- Eastman Kodak

- The New York Times

Some Notable Additions (again, not a comprehensive list):

- Intuitive Surgical

- MasterCard

- Salesforce.com

- Life Technologies

- Red Hat

- Priceline.com

- Visa

- Ross Stores

- Urban Outfitters

- Berkshire Hathaway

- TripAdvisor

- Chipotle

- Blackrock

- F5 Networks

- Netflix

Note how the list of removals is populated with many very old companies, with a heavy concentration of financials and other legacy US businesses that have either gone, are near, or were on the brink of bankruptcy. Meanwhile, the list of newcomers includes many of the hottest “new” economy companies that are core components of today’s thriving digital age. Berkshire Hathaway stands out like a sore thumb on the list of newbies, as the company entered the S&P 500 upon completion of its acquisition of Burlington Northern and splitting the “B” shares. Berkshire “replaced” BNI in the index, thus finally bringing one of America’s largest, most profitable businesses into the composite that is designed to represent American business. This is a big change, as Berkshire is now one of index’ 10 largest holdings.

This all has a meaningful impact on the intrinsic metrics of the S&P, including earnings, growth, and most importantly, performance. Priceline is the best performer on the list of newcomers, and it alone is up 779% since the market bottomed in March of 2009. That is pretty remarkable compared to Lehman Brothers, which only this month “emerged” from bankruptcy as a nearly worthless entity for equity holders.

Not that these facts alone mean the market should be moving higher, but it is very important to contextualize what we mean when we say “the S&P 500 is making new multi-year highs” and conduct any analysis that relies on index-wide metrics. Had these changes not transpired, one can reasonably guess that the S&P 500 would be closer to 1,000 than 1,400 today. And that is a good thing! Evolution is a powerful, natural force that drives things forward and helps to overcome yesterday’s vulnerabilities. It is progress, hence it is a more valuable total index.

darwin,

darwin,  evolution,

evolution,  indexing,

indexing,  lehman brothers,

lehman brothers,  priceline,

priceline,  s&p 500 | in

s&p 500 | in  The Market

The Market