GeoEye--Eyeing Value in Satellite Imaging

Elliot Turner Posted on

Elliot Turner Posted on  Thursday, March 1, 2012 at 1:17PM

Thursday, March 1, 2012 at 1:17PM Description:

GeoEye (NASDAQ: GEOY) is an integrated satellite imaging firm that owns the satellites in space and the on-ground image processing. The company contracts these resources and the accompanying service to various government and private sector entities. GeoEye has two satellites in orbit already—the IKONOS and the GeoEye-1—with a third preparing for launch sometime during the course of 2013. GeoEye-1 has a resolution of 41 centimeters, while GeoEye-2 will have a resolution of up to 25 centimeters, with the highest precision reserved for the U.S. government only. Satellite imaging is used for a variety of purposes, including but not limited to defense, disaster response, air and marine transportation, oil and gas exploration, mining production and exploration, mapping of remote regions, location-based services, insurance and risk management, agricultural crop management, etc.

Valuation:

The stock is trading at a discount to book value at $22.01/share. Tangible book value checks in at $18.17/share. Where the book value analysis gets more interesting is in trying to build out a reproduction value for the company. GEOY carries their satellite value at $817 million on their balance sheet, with $145 million of accumulated depreciation. The company’s first satellite, IKONOS has been fully depreciated since 2008, yet it remains in space and producing revenues for the company. The company operates in a capital intensive business, with significant barriers to entry, where the useful life of the assets is demonstrably longer than the time in which they become fully depreciated.

Looking at this first from the asset valuation lens, it becomes clear that for a competitor to reproduce the business that GEOY has already built would cost substantially more than the carried value on the books of the satellites. For the sake of simplicity, I think it’s fair to say that at the very least, a competitor would have to spend an amount equal to the carried value of the satellites, plus the already accumulated depreciation of $145 million, in order to viably compete with GEOY. In adding that back to the tangible book value of the company (all goodwill has been excluded) you get an adjusted reproduction value that is approximately $24.50 per share. That is a 20% premium to today’s share price.

There is further hidden value at the company in the form of a cost-share agreement with the US Government for the launch of GeoEye-1, the first color, high-precision commercial image satellite launched into space. GEOY accounts for the cost-share payments in the following way: “amounts received from the U.S. government are recorded as deferred revenue when received and recognized as revenue on a straight-line basis over the useful life of the satellite.” The gross amounts of the deferred revenue are carried in the company’s backlog and not on the books themselves until the payments are actually received from the government. Once the payments are received they are then carried as deferred revenue until they are recorded as revenue alongside the corresponding amount of depreciated cost for the satellite itself.

For 2012 and beyond, there is a total of $148 million left of repayment for the cost on the GeoEye-1 that the government pays out as $6.0 million monthly, or $24 million per quarter. Using a 12% discount rate on the remaining contract, it has a net present value of $110 million to the company. I added $110 million to the company’s reproduction value, because this provides further clarity about what a private market valuation would be, and what a potential purchaser would have to pay to buy the company. Plus there is a substantially high degree of certainty that this money will reach the company, irregardless of whether the government scales back on commercial satellite contracts (to be discussed more in risk factors below). When this is added to the tangible asset value, it gives the company an adjusted book value of $29.50, a 40% premium to today’s market price.

Next, I added the $110 million in NPV for the backlogged GeoEye-1 cost share into the cash value for my earnings power valuation and subtracted the $24 million annual amount that will be recorded as revenue from the actual earnings themselves. This helps provide a more realistic valuation of the company’s actual earnings power.

At present, the company’s earnings power value is below both its carried book value and my adjusted book value. This typically indicates that management is destroying value equal to the difference between the actual book value and the earnings power value, for even a company in a perfectly competitive environment’s earnings should be equal to the value of the underlying assets themselves. That begs the question, is management destroying value? And I think the answer is clearly no. There are several factors that negatively impact the earnings power value, one of which is the revenue recognition for government contracts, and the accelerated depreciation schedule for these satellites compared to the actual useful life. Also relevant is that once the GeoEye-2 enters space, the company has an existing contract with the government that will have the U.S. paying an additional $183 million per year for imaging and the commensurate services. When this is in place, the company’s earnings power will be $22.60 per share using a 12% WACC.

Competitive Advantages

It’s important to assess the competitive advantages for any company, particularly one in which the claim is made that the reproduction value is greater than both the asset value and the present earnings power value. Further, in order for a company to earn real economic profit, they need some kind of competitive advantage. Here is where the company is particularly unique, as GeoEye benefits from several crucial advantages, many of which pertain to barriers to entry. First, is the capital intensity of the business, as satellites are expensive to build and expensive to launch. For a startup company in the field, they would have to raise substantial capital just to get into a position to win a contract, let alone, develop the team and experience to manage the equipment itself.

Next and most importantly, are the regulatory barriers to entry. Not anyone can just launch a satellite into space. Permissions are needed at various steps along the way. Permission must be obtained for the launch itself, permission must be obtained to allow the satellite to orbit, and last, permission is needed from both a Defense and Intelligence standpoint from the government in order to take imaging of the entirety of the Earth. For logical reasons, the government doesn’t want anyone and everyone to be able to take whatever pictures of the Earth that they would like, and as a result, the government has historically monopolized and dominated this field for themselves. Collectively, the governments of the world with the capacity for astrodynamics have complete control in deciding who can and cannot launch and operate satellites, and as such, the regulatory barriers are substantial. Further, once a satellite is in space, orbiting and providing a service, it is increasingly unlikely that the government would allow yet another satellite for the same commercial purposes. The reasoning here again is simple, while space itself is vast, the space in which imaging satellites can orbit is finite. The more crowded that orbit zone is, the more likely it is that some problem would arise.

One limit to the GEOY’s competitive advantage is that in exchange for the government subsidizing a portion of the build and launch fees, and having done so following a competitive bid process, the company has little bargaining power for the costs of its services with its largest customer. This limitation is mitigated however, as the government authorizes GEOY to seek additional clients, including foreign governments and private companies, for services in which there is little competition for the reasons mentioned above. As such, the amount of services that can inevitably be sold are very scalable once the satellites are in orbit.

Customers

As of now, the US government remains the largest client of GEOY, and this should continue to be the case as the government scales down its own space operations. The US government itself represents approximately 2/3rds of the company’s revenues. GEOY has several long-term contracts with the government, the largest of which was signed in August 2010 and can reach a value up to $3.8 billion. The problem with this particular contract, and one of the overhangs plaguing the stock, is the government’s option to renew the contract annually, instead of it being guaranteed for the full term.

With the government’s budget under scrutiny and in a state of uncertainty, particularly with regard to defense spending, investors are discounting the potential value of this contract over the longer-term. The large contracts are with the National Geospatial Intelligence Agency (NGA) within the Defense Department. Duncan Scot Currie, the director of NGA’s commercial satellite operations had the following to say: “It’s a tough budget environment, but I am confident we can demonstrate the value of this program to the Congress. We have a contract that is providing tremendous value to the U.S. government and we are on schedule and on budget for developing the next generation of commercial satellites. It is reasonable to assume that budgets across the board are going to be reduced. Everybody’s going to be affected. We hope we can manage it.”

GeoEye-2 is slated to launch during 2013 along with the NGA’s other large commercial satellite customer, DigitalGlobe. The NGA has asserted they think all contracts would “stand up to the scrutiny” (quoting a paraphrase). It seems as of now the repercussion may be adding an additional “passenger” in the form of another satellite to the slated launch on the Atlas 5, a comparatively expensive spaceship, but one that is fully domestic in terms of build and operation within the US.

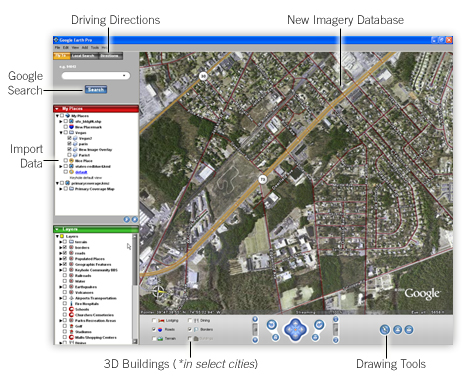

Beyond the US government, other governments around the world have contracted for GeoEye’s services, and in the private sector. In the private sector, Google uses GeoEye’s satellites for Google Earth. Just this year the company announced a “multi-million dollar contract” with the Russian government to provide imaging services, however the full terms have yet to be disclosed.

Large Buyer of Shares

Cerberus Capital Management is the single largest stockholder in GeoEye and they keep on growing. The relatively secretive private equity firm, with an outstanding track-record has bought shares as high as the $40s, and continues to accumulate their stake today. Cerberus so badly wants to buy GeoEye that they negotiated with the company and its other large stockholders to allow for an increase in the maximum beneficial ownership interest one can take before becoming an “Acquiring Person” which triggers a poison-pill against acquisition. The poison-pill was adopted during the course of 2011 and limited the maximum ownership to 20% of the outstanding stock before triggering “Acquiring Person” status. In late 2011, this maximum threshold was raised to 25%, and in early 2012 it was again raised, this time to 30%. Each time this threshold was raised, Cerberus quickly commenced further open market share purchases. Cerberus also holds debt positions in the company’s stock.

Cerberus, through its portfolio companies, is one of the 100 largest government contractors, and has deep ties with the Defense Department and government itself. They clearly understand the risks inherent in the Defense Department budgeting process, yet despite these known risks they continue to buy more. It’s unclear exactly what Cerberus intends to do with their massive stake in GeoEye (i.e. whether they intend to eventually take over the company, or just hold it passively), but what is clear is they believe that the valuation here offers a very compelling long-term investment opportunity.

In the past there had been abundant takeover rumors regarding Cerberus’ stake, having either Cerberus buying out the remainder of the firm, or setting up an acquisition by one of the other defense contractors looking to gain a foothold in the satellite imaging sector. While that is a possibility, I am not factoring in that likelihood in my analysis of the stock. More realistically, what I think Cerberus may do is facilitate commercial contracts between GeoEye and their various portfolio companies offering contract services to the government.

Risks:

The primary risks to the company today relate to the uncertainty over the Defense Department’s budget moving forward. Any large contract is subject to scrutiny, and as such, it’s impossible to determine exactly which ones will remain in force and which will be cut. As of now, the NGA’s budget has been cut by 10% for 2012, but not all the cuts will necessarily reach through to GEOY and the NGA's budget itself is classified so it's impossible to determine exactly what the impact will be as of yet. In April of this year, the White House will release the results of their own review of the EnhancedView contracts for satellite imaging services, and at that time there is the potential for further cuts from 2013 on, or for the confirmation that the conracts will proceed as planned.

As part of the review, the government is looking into the scheduled launch of GeoEye-2 aboard the Atlas 5 rocket. There is the potential for the government to require additional space-bound projects on the launch, which could delay GeoEye-2’s launch date. Any delay in the launch would push back the revenues GEOY is set to receive.

While it’s certainly possible that the contracts are scaled back, it seems highly unlikely that they would be cut entirely. The NGA has asserted that they “support commercial imagery as a vital part of geospatial intelligence, and EnhancedView as part of the commercial imagery program.” President Obama specifically credited the NGA with their crucial help in the operation to capture Osama Bin Laden and in this age of heightened tensions in the Middle East, combined with an increasingly war-weary American populace, satellite imaging is an invaluable tool in modern warfare. Further, with global warming increasingly a problem, satellite imaging has emerged as an important tool in disaster readiness and disaster response management. It's hard to imagine cuts will run too deep in this space.

Author Disclosure: No position, but may initiate within the next 72 hours.