In Defense of Cash

Elliot Turner Posted on

Elliot Turner Posted on  Thursday, March 12, 2015 at 11:01AM

Thursday, March 12, 2015 at 11:01AM There is a debate in the investment community about the merits of Schwab including a cash allocation in its new roboadvisor offering. Let us leave aside the merits of roboadvisors (short answer: they are great for some people, while terrible for others) and focus on the idea of an investor holding a steady cash allocation as a percentage of total investable assets. Betterfront and WealthFront, two of the early movers in the roboadvisor space, have piled on Schwab. The upstarts argue the cash allocation was merely a cynical ploy orchestrated by Schwab to generate higher revenues from client accounts. Schwab meanwhile argues this is merely a prudent allocation. So, is cash a good, or bad investment in a portfolio account? The answer to this debate holds implications not just for roboinvestors, but for all investors alike and sure enough, I think there is a conclusive answer (as the title suggests).

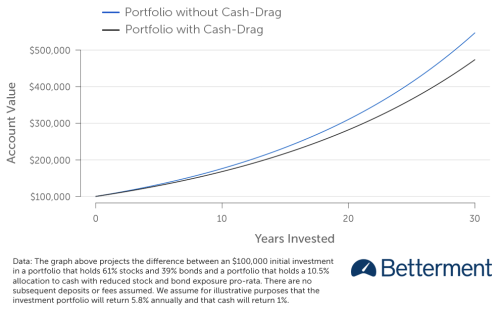

Here is Betterment’s argument against cash:

- “Cash has a significant chance of a negative real return over time due to inflation risk.”

- “Cash assets can present a conflict of interest when the investment manager is advising cash and then re-investing it for its own revenue.”

- “You never hold cash at Betterment, as we use fractional shares. That ensures every dollar—down to the penny—is fully invested in a diversified portfolio of stocks and bonds.”

The crux of these points are ancillary to the true debate. In fact, Betterment’s argument boils down to a marketing stance, more so than an investment argument. Cullen Roche at Pragmatic Capitalism nicely demonstrates how over the very long run, cash does in fact generate a nice, non-correlated return for portfolios; yet, this is merely the tip of the iceberg in defense of cash. I will do my best to round out the case here.

First, it’s important to note that Warren Buffett would strongly disagree with the roboadvisor assessment of cash. Alice Schroder offers the following take on Buffett’s perspective: “he thinks of cash differently than the conventional investors. This is one of the most important things I learned from him: the optionality of cash. He thinks of cash as a call option with no expiration date, an option on every asset class, with no strike price.” [emphasis added]. Here we have one of the foremost authorities on Warren Buffett labeling a cash allocation as amongst “the most important” elements of Buffett’s investment prowess. If cash is so important to Warren Buffett, who are these roboadvisors to say otherwise?

While this point is merely an appeal to (quite the) authority, it might be worth exploring how and why this is not merely fallacious thinking. For that, we can turn to Claude Shannon, also known as “the father of information theory.” I first cited Shannon in my post explaining how the Kelly Criterion can be used to size positions. Unsurprisingly, this was not Shannon’s only investment insight. One of the more interesting conclusions Shannon came to about investing demonstrates how it is possible to “make money off of a random walk” with cash being the secret weapon.

First let us look at the chart Betterment offered to support its case against cash, as it helps set the stage for why cash is so effective and what Betterment and WealthFront may be missing in building their story:

Notice something about both lines? There is nothing jagged or wavelike to them. Have you ever observed a stock moving in such fashion? Has any actual historical performance visually appeared as smooth these two lines other than Madoff’s fund? Sure, this is standard operating procedure for presenting simulations of what forward performance could look like in an optimized portfolio, but this is only effective as a rough guide. Reality assuredly will be different, and while no one can guarantee the end return will be different (despite this likely being the case), we all can guarantee that the path in getting from the bottom left to the top right will be different. The fact is, the path of stock price movements have consequences for portfolio returns (human behavioral consequences aside--this alone could be its own extended blog post). There is considerable evidence behind the notion that in the short run, stock market movements are merely a random walk. This is another way of saying that stock price movements will be noisy and volatile, with up and down days scattered across time following no real, predictable patterns. In many respects, this is one of the more important philosophical underpinnings behind the existence of roboadvisors in the first place. It should then be no wonder that this fact has serious consequences for the benefits of cash as a strategic allocation.

Notice something about both lines? There is nothing jagged or wavelike to them. Have you ever observed a stock moving in such fashion? Has any actual historical performance visually appeared as smooth these two lines other than Madoff’s fund? Sure, this is standard operating procedure for presenting simulations of what forward performance could look like in an optimized portfolio, but this is only effective as a rough guide. Reality assuredly will be different, and while no one can guarantee the end return will be different (despite this likely being the case), we all can guarantee that the path in getting from the bottom left to the top right will be different. The fact is, the path of stock price movements have consequences for portfolio returns (human behavioral consequences aside--this alone could be its own extended blog post). There is considerable evidence behind the notion that in the short run, stock market movements are merely a random walk. This is another way of saying that stock price movements will be noisy and volatile, with up and down days scattered across time following no real, predictable patterns. In many respects, this is one of the more important philosophical underpinnings behind the existence of roboadvisors in the first place. It should then be no wonder that this fact has serious consequences for the benefits of cash as a strategic allocation.

The following is an explanation for how cash can effectively boosts returns from Fortune’s Formula by William Poundstone:

Shannon described a way to make money off a random walk. He asked the audience to consider a stock whose price jitters up and down randomly, with no overall upward or downward trend. Put half your capital into the stock and half into a “cash” account. Each day, the price of the stock changes. At noon each day, you “rebalance” the portfolio. That means you figure out what the whole portfolio (stock plus cash account) is presently worth, then shift assets from stock to cash account or vice versa in order to recover the original 50-50 proportion of stock and cash.

To make this clear: Imagine you start with $1,000, $500 in stock and $500 in cash. Suppose the stock halves in price the first day. (It’s a really volatile stock.) This gives you a $750 portfolio with $250 in stock and $500 in cash. That is now lopsided in favor of cash. You rebalance by withdrawing $125 from the cash account to buy stock. This leaves you with a newly balanced mixed of $374 in stock and $375 cash.

Now repeat. The next day, let’s say the stock doubles in price. The $375 in stock jumps to $750. With the #375 in the cash account, you have $1,125. This time, you sell some stock, ending up with $562.50 each in stock and cash.

Look at what Shannon’s scheme has achieved so far. After a dramatic plunge, the stock’s price is back to where it began. A buy-and-hold investor would have no profit at all. Shannon’s investor has made $125.

This scheme defies most investor’s instincts. Most people are happy to leave their money in a stock that goes up. Should the stock keep going up, they might put more of their free cash into the stock. In Shannon’s system, when a stock goes up, you sell some of it. You also keep pumping money into a stock that goes down.

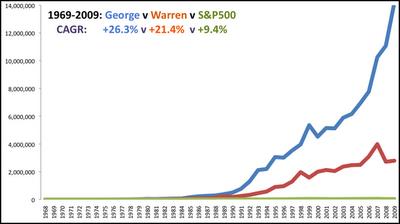

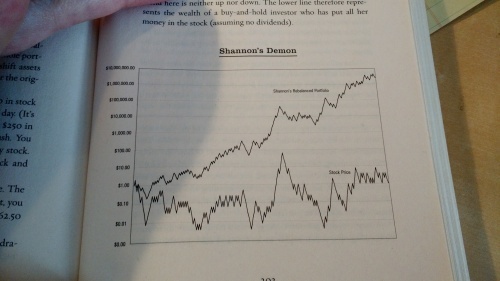

Poundstone then offers a chart of Shannon’s performance in a 50/50 cash/stock portfolio rebalanced once per each unit of time:

It turns out the rebalanced portfolio beats the fully invested portfolio while also minimizing volatility. The example above is clearly a far more extreme version of the cash allocation and stock volatiltiy Schwab (or most investors) would take on in a real portfolio; however, even in more subtle form the effect is noticeable and real. Note how jagged, rather than smooth, these lines are. Jagged lumpiness is a reality we all must contend with in financial markets.

Long-term investors of all kinds need to acknowledge how hard it is to predict short-run movements in stocks. Even in a good value investing opportunity with an impending catalyst, one can never know with certainty which way a stock will move. We can rely on “asset classes” in the most general sense to earn a positive return over long enough timeframes, but we never can now in advance how long that long-run needs to be. Further, we must also acknowledge the unfortunate reality that it is possible for decades of stagnation on price appreciation even with a growing “intrinsic value”—we call this multiple compression. In such an environment (more so than in a trending environment), cash serves as imposed discipline: one systematically buys low and sells high when this kind of rebalancing is automatic.

Clearly rebalancing is part of the roboadvisors' strategy in switching between stocks and bonds when an allocation leaves a tolerance band; however, there are long stretches of time when stocks and bonds are correlated and meaningful periods of time where cash would offer not just a strong buffer against volatility, but an actual enhancer of return. Poundstone references how counterintuitive Shannon’s methodology appears. As counterintuitive as it may be, it is assuredly true and the benefits are both actual and behavioral. If you like better returns, with less volatility, then cash must be an important component of your portfolio.