Keynes Applied To Investing Today

Elliot Turner Posted on

Elliot Turner Posted on  Monday, November 12, 2012 at 11:56AM

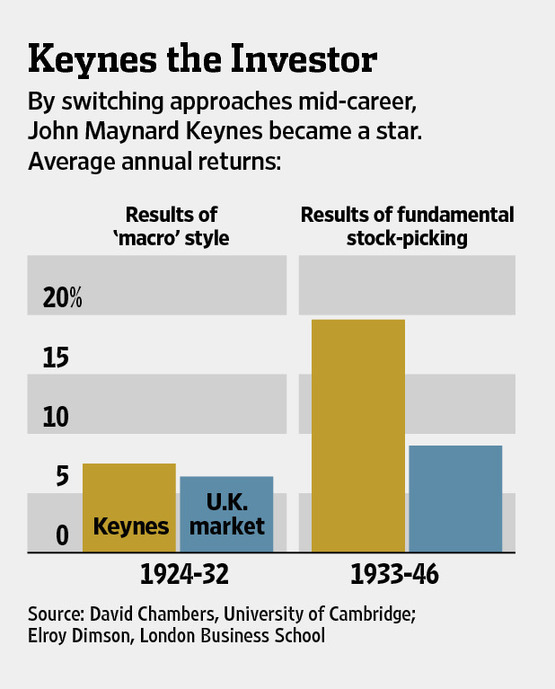

Monday, November 12, 2012 at 11:56AM Recently, both Bloomberg and the Wall Street Journal ran pieces that highlighting the investment successes of John Maynard Keynes. Both emphasize how little Keynes actually applied his economic theory to investment; instead, focusing on how Keynes operated in a very Warren Buffett-like manner. Keynes focused on valuation, applying probablistic analysis in order to decipher his risk/reward. It's enlightening to learn about Keynes' role as an active participant in markets, but these articles seem to be saying that while Keynes is the father of macroeconomic theory, he was not a macroinvestor, but rather a micro investor. In black and white terms, this is true; however, it is Keynes' superior understand if the macro landscape that I think led him to this conclusion and this chart of his performance as both a macro and micro investor should serve as a warning to many of the macrotourists out there today (Chart from Jason Zweig's article: Keynes: One Mean Money Manager):

In fact, from a reading of The General Theory, it becomes clear that Keynes' deep understanding of the role of behavioral economics, credit cycles, and the marginal efficiency of capital on investment played a crucial role in his realization that company-specific investments based on valuation made the most sense. Keynes' description of the stock market as a beauty contest should strike any reader of Benjamin Graham as akin to the Mr. Market analogy. Clearly Keynes recognized the connection between the emotional fluctuations of market temperment and its role in leading to over and undervaluation on the micro level.

Here I have pulled together 12 separate passages from Keynes that in my opinion are very relevant for today's economy. Many of these help highlight how his understanding of macroeconomics ultimately led to the conclusion that a valuation-focused investment strategy is superior, while others provide key insights to investors of all types on how and why things are shaping up as is today in the broader economy. One theme clear throughout is Keynes' understanding that a capitalist democracy inevitably requires certain bargains between capital and labor in order to survive, but that regardless, it is necessary for long-term investors to maintain an opportunity to profit. Further, Keynes' disdsain for speculators in contrast to investors is clear throughout, and this is an area which I think requires more discussion today.

1. “It is certain that the world will not much longer tolerate the unemployment which, apart from brief intervals of excitement, is associated…with present-day capitalistic individualism. But it may be possible by a right analysis of the problem to cure the disease whilst preserving efficiency and freedom.”

2. “There are valuable human activities which require the motive of money-making and the environment of private wealth-ownership for their full fruition….It is better that a man should tyrannise over his bank balance than over his fellow-citizens; and whilst the former is sometimes denounced as being but a means to the latter, sometimes at least it is an alternative…The task of transmuting human nature must not be confused with the task of managing it. Though in the ideal commonwealth men may have been taught or inspired or bred to take no interest in the stakes, it may still be wise and prudent statesmanship to allow the game to be played, subject to rules and limitations, as long as the average man, or even a significant section of the community, is in fact strongly addicted to the money-making passion.”

3. “Changing views about the future are capable of influencing the quantity of employment and not merely its direction.”

4. “A collapse in the price of equities, which has had disastrous reactions on the marginal efficiency of capital, may have been due to the weakening either of speculative confidence or of the state of credit. But whereas the weakening of either is enough to cause a collapse, recovery requires the revival of both. For whilst the weakening of credit is sufficient to bring about a collapse, its strengthening, though a necessary condition of recovery, is not a sufficient condition.”

5. “But the daily revaluations of the Stock Exchange, though they are primarily made to facilitate transfers of old investments between one individual and another, inevitably exert a decisive influence on the rate of current investment. For there is no sense in building up a new enterprise at a cost greater than that at which a similar existing enterprise can be purchased; whilst there is an inducement to spend on a new project what may seem an extravagant sum, if it can be floated off on the Stock Exchange at an immediate profit. Thus certain classes of investment are governed by the average expectation of those who deal on the Stock Exchange as revealed in the price of shares, rather than by the genuine expectations of the professional entrepreneur.”

6. “There is no clear evidence from experience that the investment policy which is socially advantageous coincides with that which is most profitable….human nature desires quick results, there is a peculiar zest in making money quickly, and remoter gains are discounted by the average man at a very high rate….Furthermore, an investor who proposes to ignore near-term market fluctuations needs greater resources for safety and must not operate on so large a scale, if at all, with borrowed money….Finally it is the long-term investor, he who most promotes the public interest, who will in practice come in for most criticism, wherever investment funds are managed by committees or boards or banks.”

7. “The explanation of the time-element in the trade cycle, of the fact that an interval of time of a particular order of magnitude must usually elapse before recovery begins, is to be sought in the influences which govern the recovery of the marginal efficiency of capital.”

8. “As the organisation of investment markets improves, the risk of the predominance of speculation does, however, increase. In one of the greatest investment markets in the world, namely, New York, the influence of speculation…is enormous. Even outside the field of finance, Americans are apt to be unduly interested in discovering what average opinion believes average opinion to be; and this national weakness finds its nemesis in the stock market….Speculators may do no harm as bubbles on a steady stream of enterprise. But the position is serious when enterprise becomes the bubble on a whirlpool of speculation.”

9. “Even apart from the instability due to speculation, there is the instability due to the characteristic of human nature that a large proportion of our positive a activities depend on spontaneous optimism rather than on a mathematical expectation, whether moral or hedonistic or economic. Most probably, of our decisions to do something positive, the full consequences of which will be drawn out over many days to come, can only be taken as a result of animal spirits–of a spontaneous urge to action rather than inaction, and not as the outcome of a weighted average of quantitative benefits multiplied by quantitative probabilities.”

10. “It is curious how common sense, wriggling for an escape from absurd conclusions, has been apt to reach a preference for wholly “wasteful” forms of loan expenditure rather than for partly wasteful forms, which, because they are not wholly wasteful, tend to be judged on strict “business” principles. For example, unemployment relief financed by loans is more readily accepted than the financing of improvements at a charge below the current rate of interest; whilst the form of digging holes in the ground known as gold-mining, which not only adds nothing whatever to the real wealth of the world but involves the disutility of labour, is the most acceptable of all solutions.”

11. “The later stages of the boom are characterised by optimistic expectations as to the future yield of capital-goods sufficiently strong to offset their growing abundance and their rising costs of production and, probably, a rise in the rate of interest also. It is of the nature of organised investment markets, under the influence of purchasers largely ignorant of what they are buying and of speculators who are more concerned with forecasting the next shift of market sentiment than with a reasonable estimate of the future yields of capital-assets, that, when disillusion falls upon an over-optimistic and over-bought market, it should fall with sudden and even catastrophic force. Moreover, the dismay and uncertainty as to the future which accompanies a collapse in the marginal efficiency of capital naturally precipitates a sharp increase in liquidity preference.”

12. “Later on, a decline in the rate of interest will be a great aid to recovery and, probably, a necessary condition of it…. But, in fact…it is not so easy to revive the marginal efficiency of capital, determined, as it is, by the uncontrollable and disobedient psychology of the business world. It is the return of confidence, to speak in ordinary language, which is so insusceptible to control in an economy of individualistic capitalism. This is the aspect of the slump which bankers and business men have been right in emphasising, and which the economists who have put their faith in a “purely monetary” remedy have underestimated.”

Reader Comments